closed end loan disclosures

I The circumstances under which the rate may increase. Of the disclosures you list here would be the status in a closed-end home equity loan.

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Find An Online Mortgage Lender With A Great Mortgage Rate.

. Lately I have reviewed multiple closed-end loan advertisements with the same compliance issue not providing the required disclosures when a trigger term was present. A trigger term is an advertised term that requires additional disclosures. The disclosures shall be provided to consumers at least 210 but no more than 240 days before the first payment at the adjusted level is due.

Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling. Early TIL not applicable. You have to look at each requirement separately as they have different standards for applicability.

The loan may require regular principal and interest payments or it may require full principal payment at maturity. Regulation Z Reg Z requires certain disclosures be made to the member before. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie.

This model clause illustrates the variable-rate disclosure required under 102618 f 2 which would alert consumers to the fact that the transaction contains a variable-rate feature and that disclosures were provided earlier. The Loan Estimate is provided within three business days from application and the. 1 The amount or percentage of any downpayment.

102637 Content of disclosures for certain mortgage transactions Loan Estimate. Part 33 - Variable Rate Closed-end Personal Loans. 4 The annual percentage rate and if the rate may increase after consummation the following disclosures.

For closed end dwelling-secured loans subject to. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. H Series of sales -.

If the first payment at the adjusted level is due within the first 210 days after consummation the disclosures shall be provided at consummation. B The merchant or third-party creditor permits consumers to return any goods financed under the plan and provides consumers with a sufficient time to reject the plan and return the goods free of cost after the merchant or third-party creditor has provided the written disclosures required by 10266. Regulation Z- Closed End Home Equity Loans Disclosure Requirements The federal Truth in Lending Act governs all consumer credit transactions.

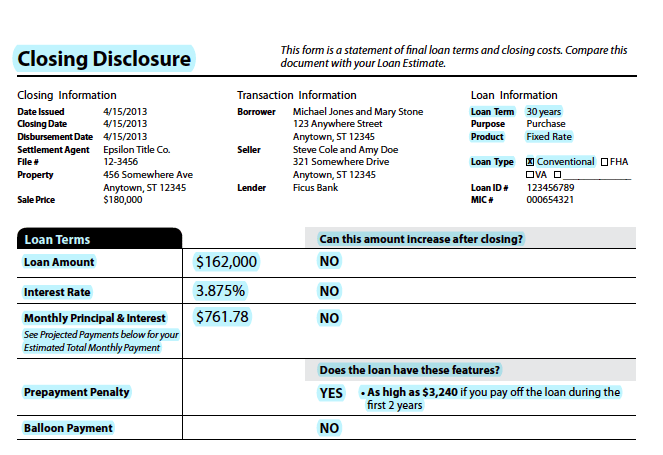

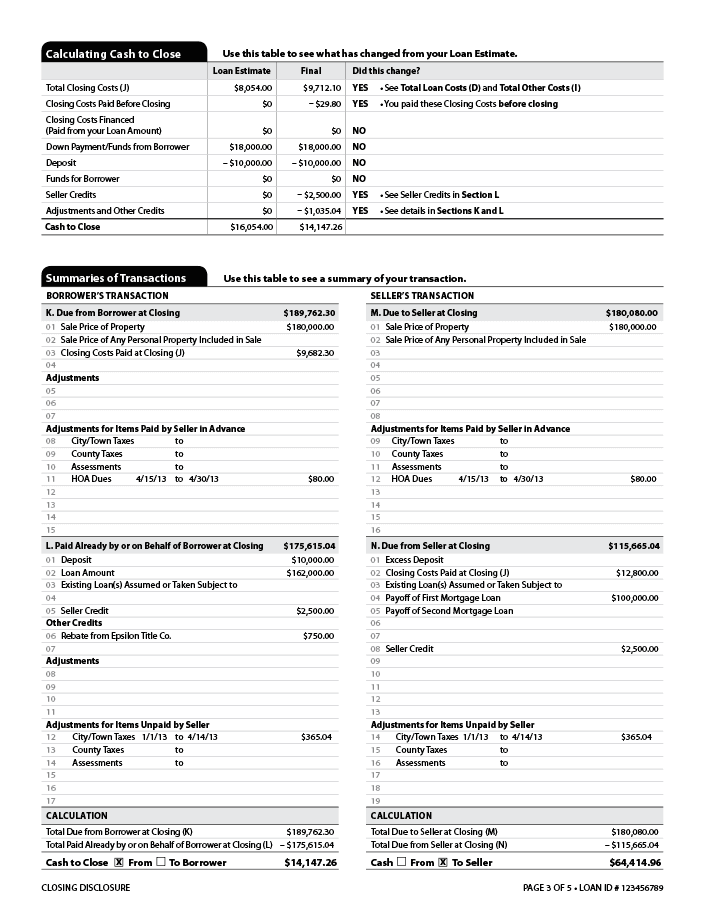

Regulation Z outlines specific disclosure requirements for closed end credit. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. Accordingly the disclosures required by 102618 apply only to closed-end consumer credit transactions that are.

Ii Any limitations on the increase. The circumstances under which the rate for the loan may vary including disclosures of the intervals at which the lending institution may change the rate on the loan the times. Ad Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a specific date. Section 332 - Disclosures. The Mortgage Disclosure Improvement Act MDIA was enacted in 2008 and mandated changes to the content of Truth in Lending disclosures when provided for real estate or dwelling secured credit.

5 The terms of repayment. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure. 22619a1 and 22619a2 10.

Official interpretation of 20 d Initial rate adjustment. Dodd-Frank Act to integrate the mortgage disclosures under TILA and RESPA sections 4 and 5. Section 102619 e and f applies to closed-end consumer credit transactions that are secured by real property or a cooperative unit other than reverse mortgages subject to 102633.

These types of loans are often referred to as second mortgage loans even though they may not be in second lien position. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. Closed-End Credit Disclosure Forms Review Procedures Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID.

Iii The effect of an increase. This model clause illustrates the early disclosures required generally under 102619 b. The disclosures need not be given by any particular time before consummation except in certain mortgage transactions and variable-rate transactions secured by the consumers principal dwelling with a term greater than one year under 102619 and in private education loan transactions disclosed in compliance with 102646 and 102647.

In 2009 Regulation Z was amended to implement MDIA requirements for. Trigger terms when advertising a closed-end loan include. By a Consumers Dwelling Appendix G to Part 1026 Open-End Model Forms and Clauses Appendix H to Part 1026 Closed-End Model Forms and Clauses Appendix I to Part.

Regulation Z now contains two new forms required for most closed-end consumer mortgage loans.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Federal Register Truth In Lending Regulation Z

What To Know About The Loan Estimate Closing Disclosure Cd

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau