sales tax permit tulsa ok

Returns for small business Free automated sales tax filing for small businesses for up to 60 days. The state sales tax rate in Oklahoma is 4500.

Veteran Eligibilty For The Ok Dav Disabled American Veterans Please Go To The Www Okdav Org Website For A Veterans Services American Veterans Veterans Home

We would like to show you a description here but the site wont allow us.

. It costs 20 to apply for an Oklahoma sales tax permit. Ad Avalara can help you automate the sales tax registration process. Theres also a convenience fee of 395 for paying.

Get Licening for my Creek County. There is no applicable special tax. Oklahoma Sales Tax Permit Simple Online Application.

For example the Oklahoma Business Registration Packet or Packet A contains information and the forms to apply for a sales tax permit or to set up an income tax withholding account. Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use. How long does it take to get an Oklahoma sales tax permit.

With local taxes the total sales tax rate is between 4500 and 11500. The Permit Center is responsible for department functions including. Ad Oklahoma Sales Tax Permit Wholesale License Reseller Permit Businesses Registration.

The fee for a sales tax permit in Oklahoma is 20 for the first location and 10 for each additional location. Your sales tax permit will be issued on a probationary basis. Oklahoma has recent rate changes Thu Jul 01 2021.

Tulsa County - 0367. Virtually every type of business must obtain a State Sales Tax Number. Ad OK Zoning Clearance Permit App More Fillable Forms Register and Subscribe Now.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. State of Oklahoma - 45. Oklahoma Sales Tax Permit Simple Online Application.

Oklahoma Sales Tax Permit Application Fee Turnaround Time and Renewal Info. Get Licening for my Retail Sales tax id in 74136 Tulsa sales permits for Tulsa OKTax ID Registration Requirements for Retail Sales in. Youll go to the Tax Commission office in Oklahoma City or Tulsa.

Ad Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. Fill out one form pick the states to register in and well do all the heavy lifting. Applying for an Oklahoma Sales Tax Permit is free and you will receive your permit 5 days after filing your.

Ad Avalara can help you automate the sales tax registration process. See our Tutorials and. Fill out one form pick the states to register in and well do all the heavy lifting.

Sales Tax in Tulsa. The sales tax permit is issued after applying for the. Ad Oklahoma Sales Tax Permit Wholesale License Reseller Permit Businesses Registration.

How much does it cost to apply for a sales tax permit in Oklahoma. If your business sells products on the internet such as eBay or through a. This probation lasts for six months.

Complete in Just 3 Steps. General Information on Oklahoma Sales Tax. You can print a.

EBay Selling DBA sales tax permit oklahoma in Tulsa OK 13617674135sales tax permit oklahoma eBay Selling. Many permitting activities can be done online using the Self-Service Portal. No credit card required.

Sales permits for Tulsa OK Retail Sales. Most businesses selling a product or offering certain services will need to register for an Oklahoma sales tax permit. Apply For Your Oklahoma Sellers Permit.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

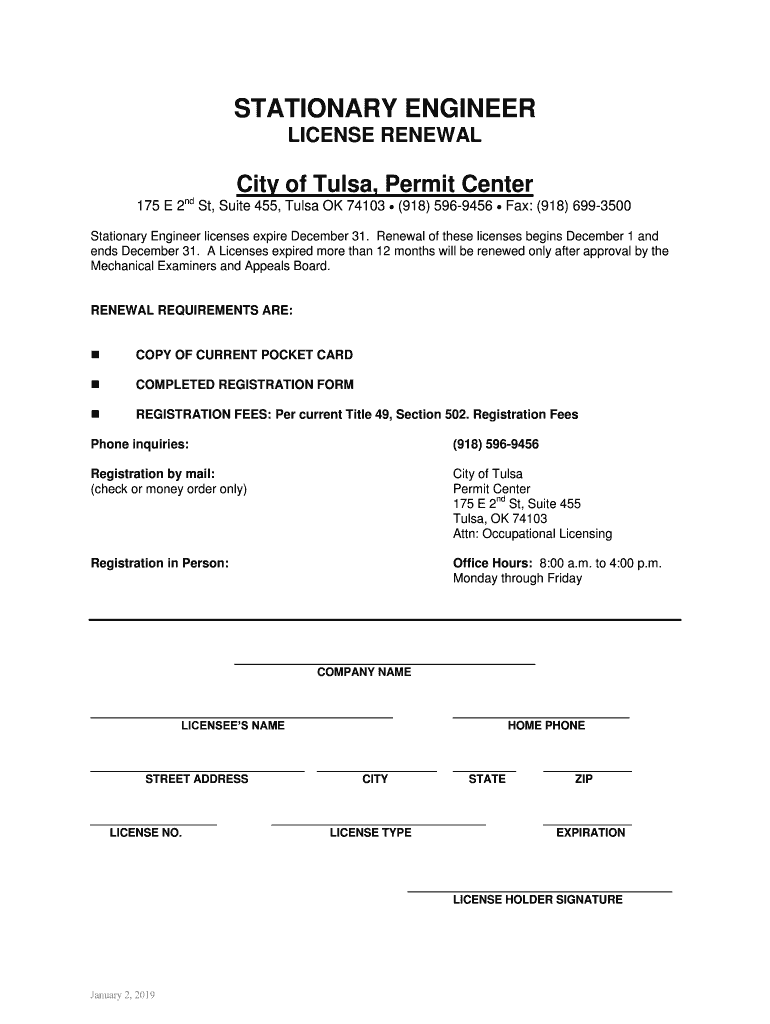

Ok Stationary Engineer License Renewal Tulsa City 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Attorneys Blog Murphy Schiller Wilkes Llp

Oklahoma Sales Tax Small Business Guide Truic

How To Register For A Sales Tax Permit In Oklahoma Taxjar

Oklahoma Ad Valorem System Tulsa County Assessor

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

How To Obtain An Outdoor Sellers License The City Of Tulsa Online