richmond property tax rate

Property owners can choose to pay their taxes in person by mail or online. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Formulating real estate tax rates and conducting appraisals.

. The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. Richmond City collects on average 105 of a propertys assessed. Macomb County Homestead Tax Rate Comparisons.

A 10 yearly tax hike is the maximum raise allowed on the capped properties. Rockingham NC 28379 Business. As catalytic converter thefts rise in the Richmond area local police promote new deterrence measure.

Electronic Check ACHEFT 095. Richmond County collects on average 103 of a propertys. For information and inquiries regarding amounts levied by other taxing authorities please contact.

7 hours agoA city resident with property assessed at 400000 would have an annual tax bill of 4800 under the citys current tax rate. To view the Total Homestead Tax Rates for Cities Villages in Macomb County please click here. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL.

RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. Real Estate and Personal Property Taxes Online Payment. Taxpayers can either pay.

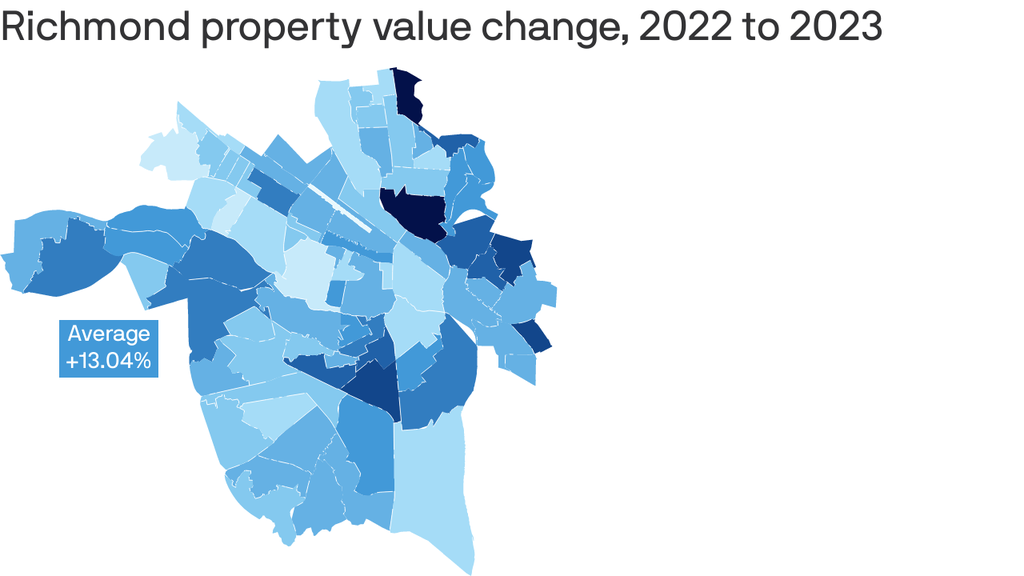

These agencies provide their required tax rates and the City collects the taxes on their behalf. WWBT - Competing tax proposals looking to lower the current property tax rate by four and 10 cents respectively will go head to head at Richmond City Hall. With the 13 jump the property owner would pay 624.

Angel Hatfield City Treasurer. These documents are provided in Adobe Acrobat PDF format for printing. Taxing units include Richmond county.

Welcome to the official Richmond County VA Local Government Website. Vagas Jackson Tax Administrator 1401 Fayetteville Rd. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

With the citys tax rate at 120 per 100 of assessed value an owner of property assessed at. Along with collections property taxation involves two additional general steps. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

The City Assessor determines the FMV of over 70000 real property parcels each year. Personal property tax bills have been mailed are available online and currently are due June 5 2022. 295 with a minimum of 100.

A look at the first phase of Richmonds 24 billion Diamond District project. Each unit then is given the assessed amount it levied. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

We have done our best to provide links to information regarding the County and the many services it provides to its. Building Department. Paying property taxes in person can be done at the Madison County Clerks Office which is located at.

Establishing real estate tax rates and directing. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being. For a house assessed at the current median sales price of 325000 the.

Along with collections real estate taxation takes in two additional common steps ie. Under the state Code reexaminations must occur at least once within a three-year timeframe.

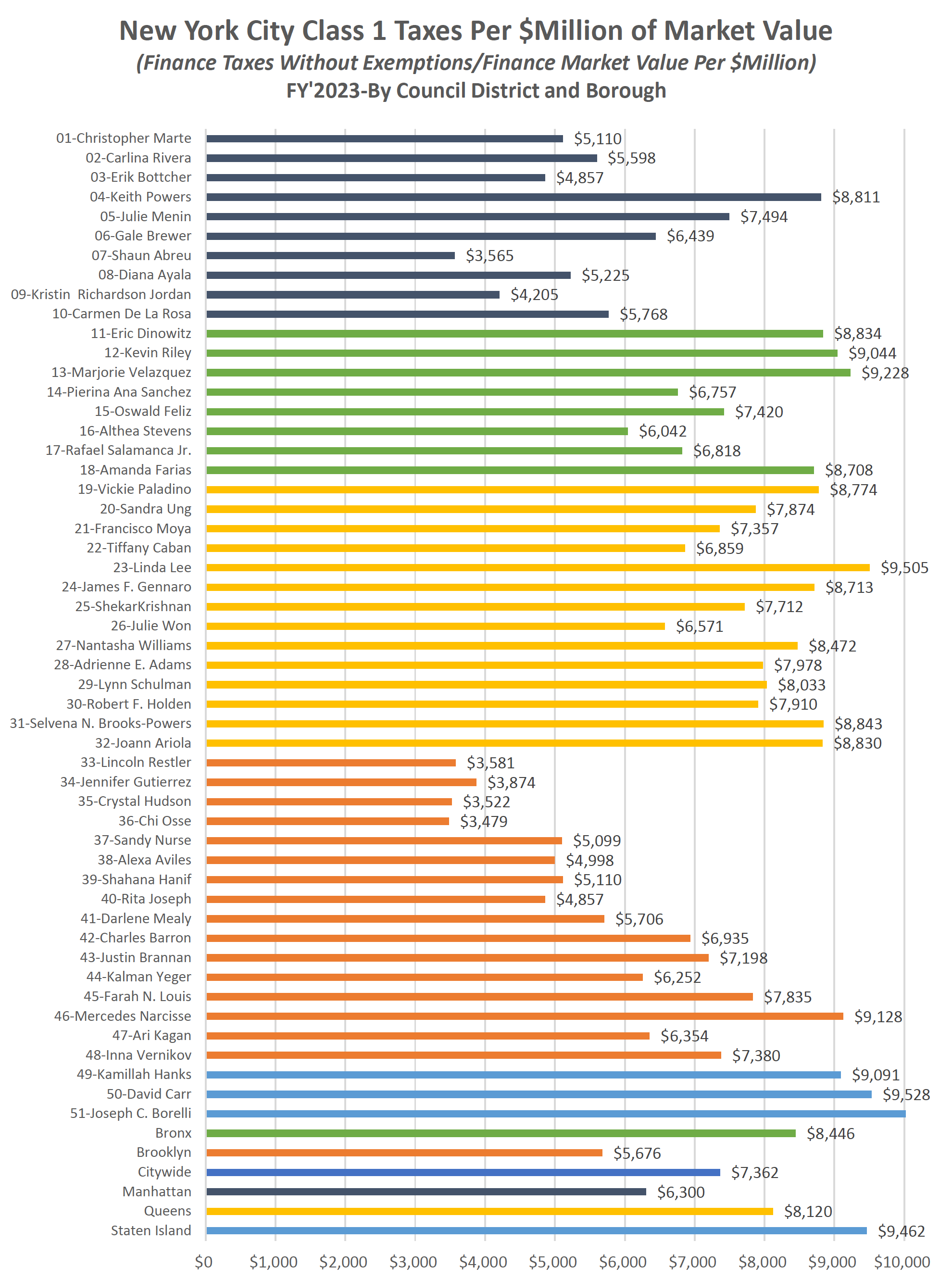

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536070_FGLLru2VgA00vFi.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

A Reminder That If You Richmond Ri Town Government Facebook

About Your Tax Bill City Of Richmond Hill

Richmond Commission On Track To Cut Property Tax News Richmondregister Com

Property Tax Rates Berkshirerealtors

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

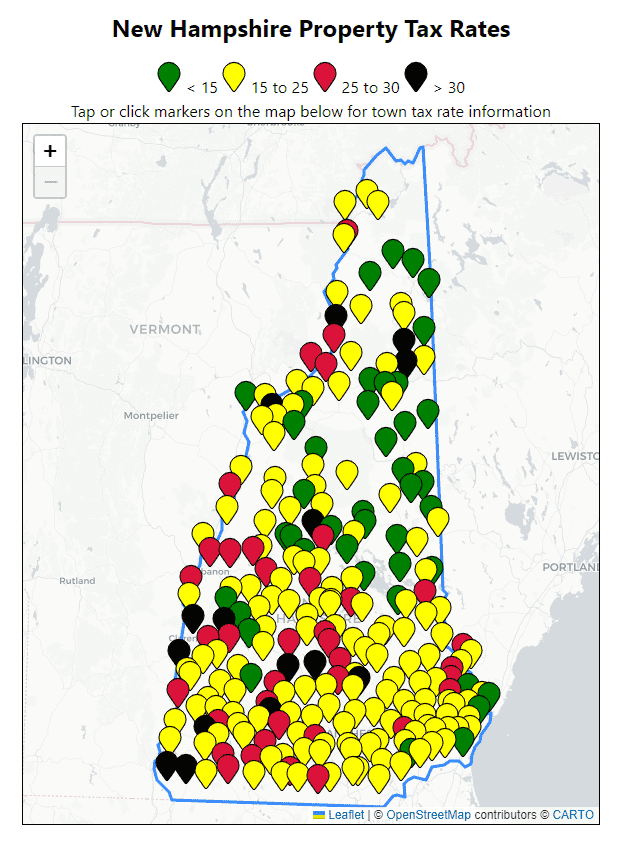

All Current New Hampshire Property Tax Rates And Estimated Home Values

Gta Cities With The Highest And Lowest Property Taxes Storeys

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

Ontario Property Tax Rates Lowest And Highest Cities

Real Estate Tax Chart Rates For Metro Richmond Ann Vandersyde Virginia Properties Long Foster Real Estate

Newton City Council Sets 2022 Property Tax Rates Newton Ma Patch

/cloudfront-us-east-1.images.arcpublishing.com/gray/WX64WUMPSVE6BGUFY6IATPDDBA.jpg)

/do0bihdskp9dy.cloudfront.net/10-19-2022/t_c720c2fd739c4aae8eb49bf0727fe3db_name_file_1280x720_2000_v3_1_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/MT5ZZF4QFVCCJEU2GSTB2WPBZM.jpeg)