tax sheltered annuity vs 401k

IRA Roth IRA 5500 for MAGI 61k Single 457 18000 403 b 18000 You can contribute the maximum in each of these. TSA as Defined by IRS.

Tax Sheltered Annuity Faqs Employee Benefits

Ad US Tax Treaty Countries nonresident aliens can take a tax free withdrawal.

. The difference between the plans makes the advantages of 401k and 401a plans more comprehensible. You pay taxes upfront in Roth 401k plans and no taxes when you withdraw from the account. There are no taxes to pay as long as you follow IRS regulations.

Just as with a. Another name for a 403b plan is a tax-sheltered annuity plan and the features of a 403b plan are corresponding to those found in a 401k plan. So whats the difference.

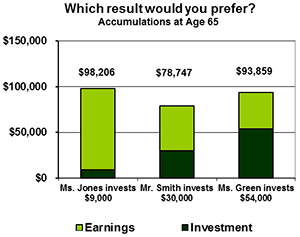

Draw US Retirement account should be pre tax planned utilizing tax savings strategies. Tax-sheltered annuity example The chief advantage of a TSA is that it can help reduce your taxes. Some companies also offer a Roth 401 k option in which case it.

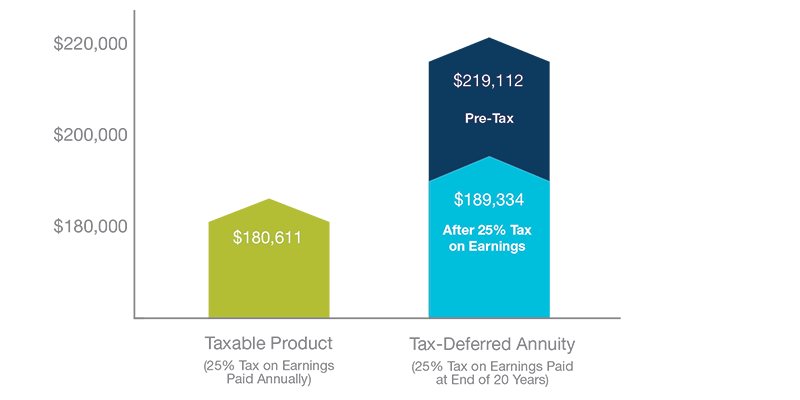

Dont Pay Taxes Until You Withdrawn Income. You will not owe income taxes on the investment returns of a 401 k or annuity until you withdraw. Traditional 401 ks let you contribute pre-tax income and pay taxes on contributions and gains upon withdrawal.

Its similar to a 401k plan maintained by a for-profit entity. Money pulled from your paycheck and put into a 401 k lowers your taxable income so you may see the total amount of taxes you pay go down. Draw US Retirement account should be pre tax planned utilizing tax savings strategies.

However any 401 k can benefit from an annuitys flexibility. What steps do you need to take to get your. There is a 10 penalty imposed by.

Both annuities and 401 ks provide a tax-sheltered way to save for retirement. By Retirement Advisor Aug 16 2022 2 Comments. Ad US Tax Treaty Countries nonresident aliens can take a tax free withdrawal.

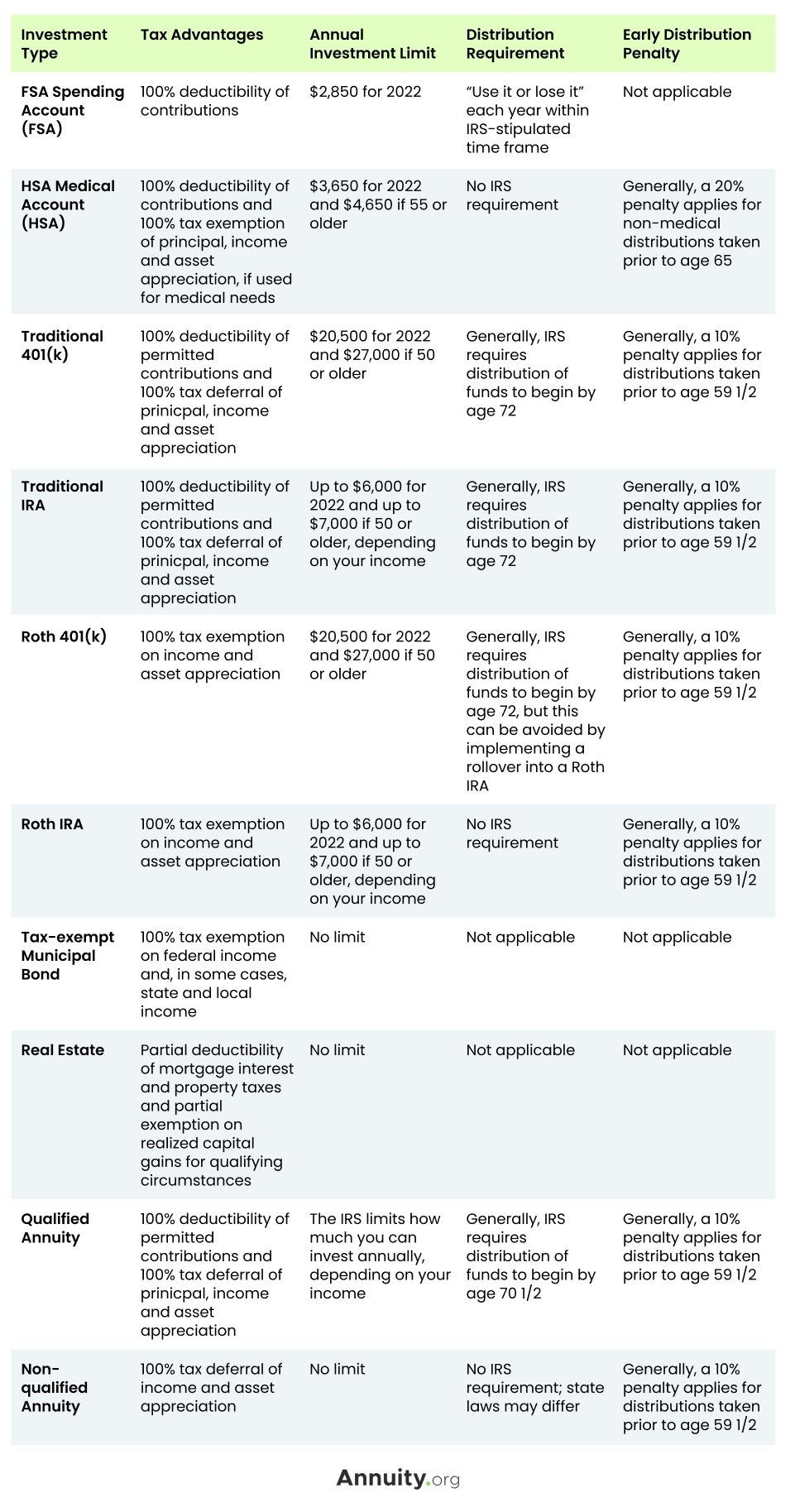

Because there are tax advantages there are. The major difference between annuities and 401 k plans is that with an annuity the individual invests hisher own money while a 401 k comes from an employment source. If you can choose.

Suzy is a professor of rhetoric at a public university with a 70000 annual salary. Tax sheltered annuity. 401 k contributions are invested in securities--normally mutual funds--and the employee is responsible for choosing the ones to invest in.

One can also opt for the 403 b plan for extra advantages after perusing. 403 b contributions are. Roth 401k plans are similar but offer tax advantages.

How To Transfer Your 403b To Another Account. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Another historical difference between 403 b and 401 k plans lies in the investment options each offer although that distinction lessens over time.

One advantage of buying an annuity within your 401if youre femaleis that your gender wont affect the price. You have three selections for tax-advantaged savings. In addition you wont.

A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. You can contribute up to 4000 per annum to your 401k fund and the tax is deferred until you start receiving monthly payments upon retirement. Once also known as.

When its time to withdraw money in retirement you will pay taxes on your capital gains with annuities while paying taxes on the total distribution amount for 401 k accounts. The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan offered by public schools colleges and universities and 501 c 3. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

Annuity prices reflect life expectancy and outside of a 401. To participate in the plan the eligibility is.

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

What Is A Tax Sheltered Annuity Due

Cpa Worldwide Tax Service Pc Just Another Wordpress Site Chandler Az Cpa Worldwide Tax Firm Chinese Cpa Page Tax Services Quickbooks Income Tax Return

What Are Tax Sheltered Investments Types Risks Benefits

Withdrawing Money From An Annuity How To Avoid Penalties

How To Avoid Paying Taxes On Annuities Due

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxation And Distribution

What Is A Tax Sheltered Annuity Youtube

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

Annuity Values How To Read An Annuity Statement

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Suze Orman Talks Pros And Cons Of Annuities

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Withdrawing Money From An Annuity How To Avoid Penalties

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

What Are Tax Sheltered Investments Types Risks Benefits

403 B Plan Guide To Tax Sheltered Annuity Plan For Retirement Focus On The User